The fintech space is exploding with investing, budgeting, and other financial services apps. At their core, these apps rely on banking APIs to access user data and make transactions. As a result, banks and other financial institutions must ensure that their APIs meet high standards to encourage adoption and provide a consistent user experience.

Let's look at five key trends in fintech API development and how to ensure your organization is on the right track.

APIs are becoming increasingly central to financial institutions and fintech apps – here are five key trends to watch when building out modern APIs.

#1. Developer Experience

Most modern software applications extensively use APIs, from authentication to fetching user data from various sources. For example, Auth0 provides an API for authentication with client SDKs for multiple programming languages and frameworks. In fact, many startups are taking an API-first approach to build their businesses!

Given the central role of APIs, the developer experience for API consumers is becoming critical to success. As a result, financial institutions must raise awareness of their APIs to attract developers and provide high-quality documentation, client SDKs, and a clear roadmap to help them integrate and maintain the API connections.

Stripe is an excellent guidepost for building an optimal developer experience. As one of the first and largest API-first fintech companies, it provides extensive developer documentation, SDKs for every major platform, and even sample applications and tutorials to help developers understand how to implement Stripe in their apps.

#2. API Design Standards

Developer experience hinges largely on API standards. That is, developers must be confident that an API behaves in expected ways. A financial institution that provides two APIs should have consistent data types and behaviors across both APIs. Developers rely on this consistency to ensure their apps don't experience errors or crashes.

Effective API standards rely on a combination of design and technical enforcement. Using a design-first approach, financial institutions can easily ensure that their APIs adhere to uniform standards. Then, they can use SwaggerHub and other tools to help enforce these standards at a code level throughout the organization.

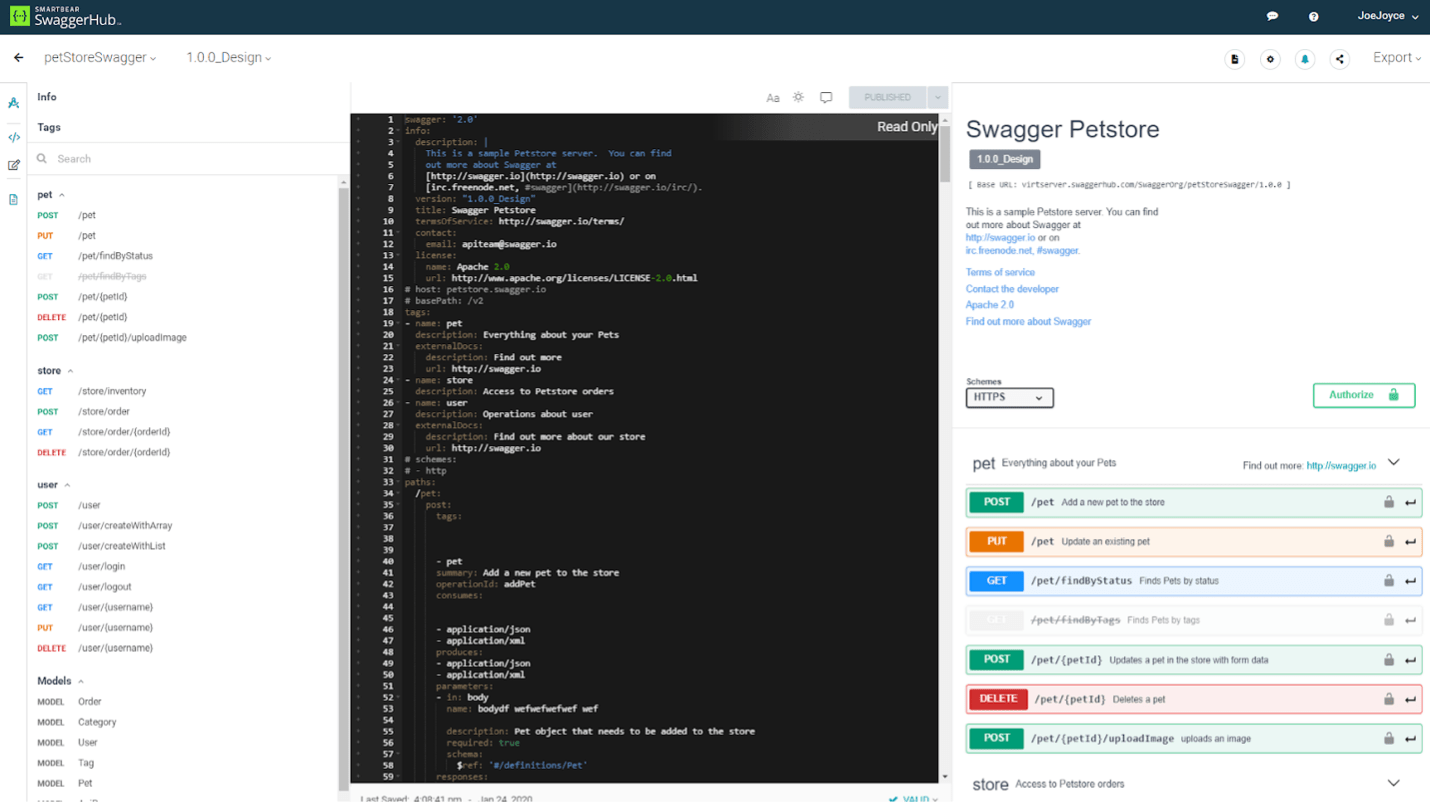

SwaggerHub makes it easy to develop standardized APIs and deliver a consistent developer experience. Source: SwaggerHub

SwaggerHub has several unique features and capabilities to help with design standards, including:

- Smart error feedback and syntax autocomplete within your editor

- The ability to create mock APIs automatically as you design

- Embedded API design rules that reinforce standards in real-time

- Domains for cataloging and reusing OAS syntax across APIs

In addition to these features, SwaggerHub provides team communication tools and enablers hosted, interactive API documentation to help keep everyone on the same page. The platform also integrates with GitHub, AWS, Azure, and other tools that many organizations already use, along with continuous integration and deployment processes.

#3. Multi-Protocol APIs

Representational State Transfer (REST) APIs are the most common way to share data across applications. Unlike SOAP or other protocols, REST APIs use HTTP to request an action or fetch information. It's also easy for developers to build wrappers around REST APIs to support their own programming languages and frameworks.

However, many fintech applications require a multi-protocol approach that extends beyond REST. For example, a stock market app showing real-time data may require a Websockets connection that continuously sends data. And in these instances, it's challenging to create a consistent developer experience and standardize access to resources.

Fortunately, SwaggerHub supports event-driven architecture through the AsyncAPI specification. As a result, organizations can keep all API development under a single roof. The AsyncAPI specification supports Kafka, MQs, MQTT, Websockets, and other event-driven protocols, making enforcing standards across all APIs easy.

For more on event-driven architectures, check out our free webinar on what’s next for asynchronous protocols.

#4. Contract Testing

Many financial institutions are moving away from a siloed monolithic architecture to microservices. While the approach adds flexibility and scalability, it also introduces new challenges with coordinating different teams that need to work together seamlessly. That significantly complicates quality assurance and testing best practices.

The move to microservices architectures has led many teams to move away from end-to-end integration tests for all APIs and toward earlier contract testing approaches. API contract testing involves validating both the server- and client-side with an OpenAPI contract to detect and diagnose when the contract breaks or malfunctions.

Pactflow easily incorporates contract tests into your API project using Pact and OpenAPI specifications. Additionally, while Pact is consumer-driven, Pactflow adds provider-driven tests to help financial institutions ensure their APIs are robust on both sides. You can also easily incorporate these tests into existing CI/CD processes.

#5. Virtualization

Financial institutions often have development teams working in parallel to accelerate time to market. For instance, a server-side team might be building an API while a front-end team is building a mobile app that consumes the API. Unfortunately, these workflows mean that the front-end team often waits on the back-end team to finish API endpoints.

API virtualization is essential to help different teams work in parallel. For example, ReadyAPI's virtualization tools make it easy to generate realistic mock APIs based on a shared specification for front-end teams. For instance, you can import OpenAPI specifications or even record live API or UI traffic to provide practical development and quality assurance data.

In addition to mock APIs, SwaggerHub makes it easy to generate client SDKs in JavaScript, Java, C#, Objective C, Swift, Android, and other languages. These SDKs contain a wrapper class that makes it easy for front-end developers to call the API from their applications without worrying about writing boilerplate code.

For more information, check out our free webinar about how to virtualize APIs in minutes and test them in seconds.

The Bottom Line

APIs have become the critical infrastructure that connects financial institutions with their internal applications and a growing number of third-party apps. While creating and managing APIs can be daunting, new specifications and technologies make it easier to develop consistent APIs and to optimize the developer experience.

If you're interested in learning more, create a free SwaggerHub account or start a free ReadyAPI trial. Or, contact us today to schedule a demo and learn how these solutions can help support your API development.