Digital Transformation in Fintech: 5 Key Challenges

Financial services extensively use both internal and external APIs. For example, a fintech startup might use open banking APIs to initiate funds transfers or monitor transactions. Or, a bank may have internal microservices, web applications, and mobile applications that use APIs to communicate. And in both cases, failure is not an option.

Let's take a closer look at why you should use contract testing over integration tests, how Pactflow's bi-directional support makes contract testing scalable, and success stories in the financial services industry.

API contract testing eliminates many problems with integration and E2E tests, making it easier to ensure a robust experience for internal and external API consumers.

#1. Compliance

Large parts of Europe, including the U.K., introduced open banking regulations in 2015 and 2016, requiring financial institutions to provide consumers with access to their data. In addition to providing access to consumer data, the rules cover everything from strong customer authentication to enforcement actions for companies that aren't compliant.

In the U.S., the Consumer Financial Protection Bureau (CFPB) is considering a new rule that would let consumers share their financial data with third parties. However, the agency has reservations about consumer privacy and data protection and, for the time being, delayed the program.

The different cross-border regulations and requirements introduce an added complexity for financial institutions operating across multiple jurisdictions. Moreover, some of these regulations include technical requirements that financial institutions must diligently implement, especially related to API design and authentication.

#2. Agile Development

Many banks and financial institutions use legacy technologies and processes that limit agility. For instance, many banks still use mainframe technologies under the hood, and applications built atop these mainframes tend to be complex and functionally siloed. As a result, adopting and integrating new technologies can be difficult.

Agile development involves breaking down large projects into small pieces and continuously delivering changes over time. And, of course, end-to-end testing, API contract testing, and other quality assurance processes are necessary to provide these teams with enough confidence to deploy new changes continuously into production environments.

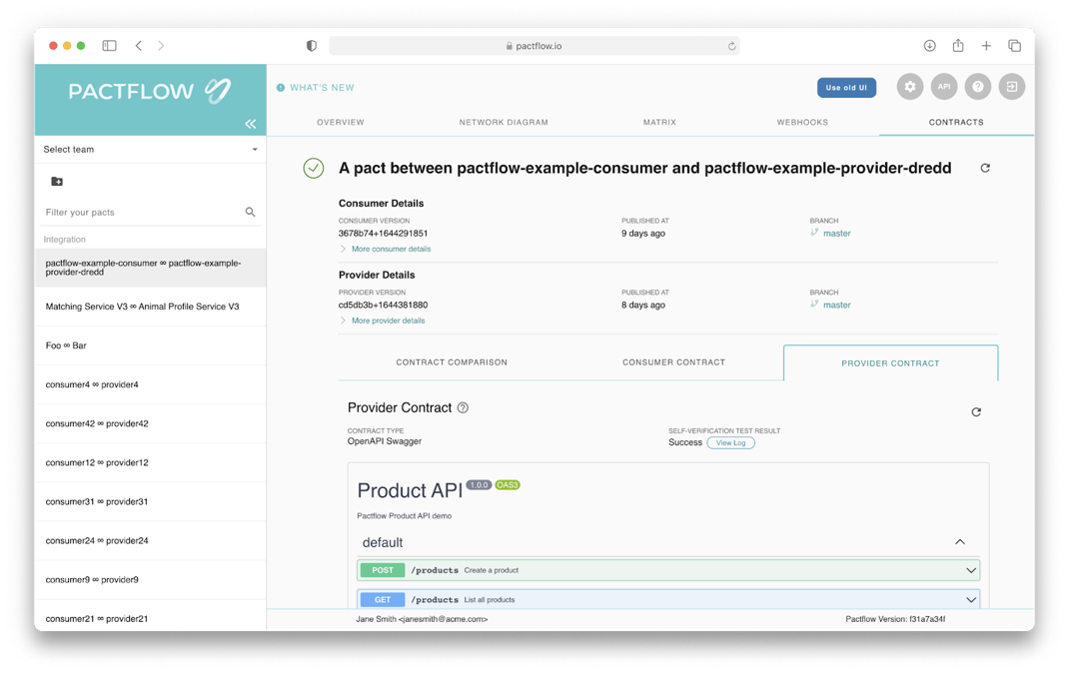

Bi-directional contract testing is essential for partners requiring a tight API integration. Source: Pactflow

For example, Pactflow makes it easy to implement comprehensive API contract testing as an alternative to slow, error-prone, end-to-end integration tests. After capturing interactions between two services, Pactflow builds a contract that API developers and consumers can use to verify an API works before pushing new changes live.

#3. Customer Expectations

Performance, availability, and usability significantly impact customer adoption and satisfaction. For example, if a bank's API goes down due to heavy traffic, customers using fintech apps to access their data can quickly become frustrated. These negative experiences can lead to churn in a market driven by third-party apps.

Most software development teams are familiar with functional tests, but these tests have some fundamental limitations. For example, poorly written code might pass functional tests, but it could cause scalability issues when it runs thousands of times in production. And since APIs are the lifeblood of modern banks, performance testing is a must.

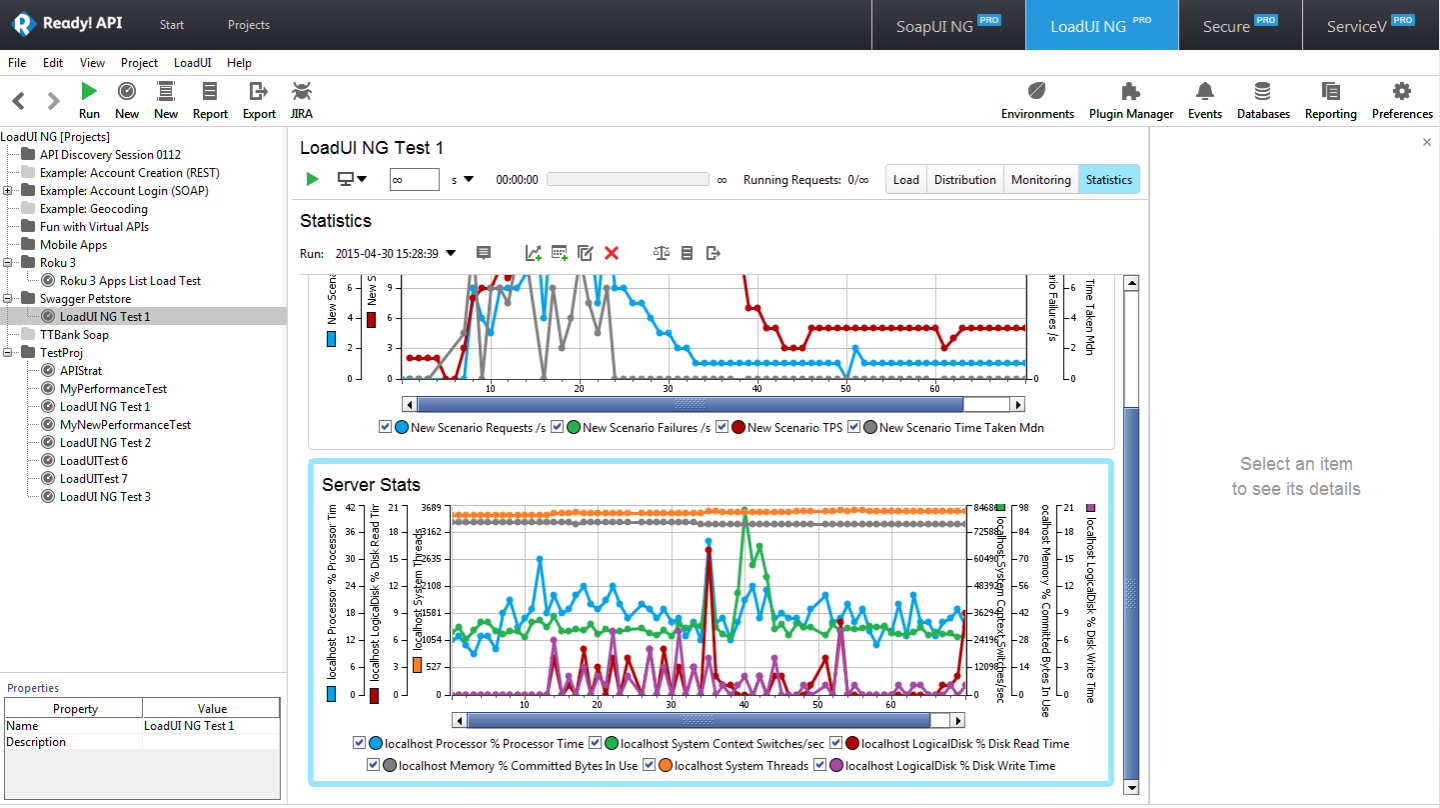

ReadyAPI makes it easy to monitor load tests as they run on a server. Source: SmartBear

ReadyAPI makes it easy to create, manage, and execute load, stress, and endurance tests within a CI/CD pipeline. Unlike many other solutions, the platform doesn't require any background in load testing and makes it easy for anyone to create and execute tests. In addition, you can quickly access the diagnostic information you need to fix bottlenecks.

#4. API Standards

Financial service APIs should be usable and predictable from a developer standpoint. Therefore, in addition to following well-established standards, organizations should ensure that they provide comprehensive documentation, client libraries, and clear communication regarding versioning, breaking changes, and upcoming features.

Many organizations make the mistake of using a “code-first” approach to API development, where they write code based on business requirements and focus on documentation later. However, a better “design-first” method involves converting business requirements into a human and machine-readable contract, such as a Swagger document, and then writing code.

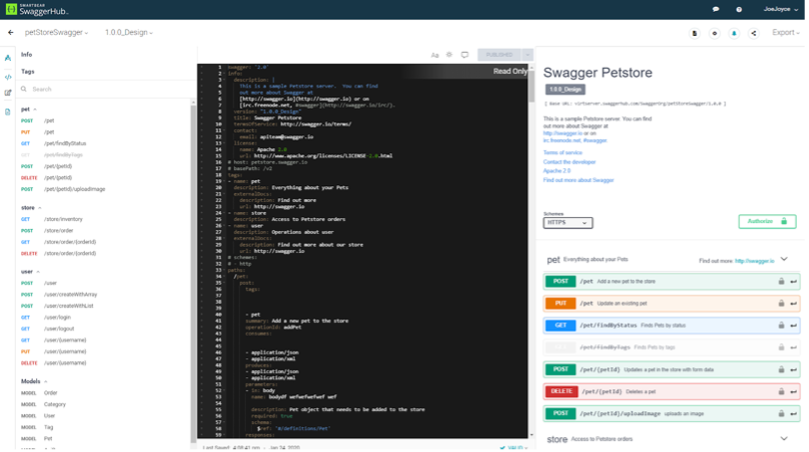

SwaggerHub Editor makes it easy to build standardized APIs. Source: SmartBear

By creating a Swagger document first, organizations can visualize how an API will behave, validate API design in real-time, and automatically generate documentation and client libraries. SwaggerHub extends these capabilities with domains for reusing syntax across APIs, team management tools, hosted documentation, and more.

#5. Scaling a Brand

Building a high-quality and performant API is only the first half of digital transformation in fintech. After the technical piece, organizations must engage the developer community, manage critical partners, ensure ongoing compliance with new regulations, and ultimately optimize business outcomes through widespread adoption.

The adoption curve typically starts with internal APIs before moving on to partners, including suppliers, providers, or resellers needing tight integration. After these initiatives demonstrate stability and scalability, organizations can move on to creating a public API that external partners and developers can use in the fintech space.

The best way to support and scale a brand is by making it as easy as possible for developers. For example, developer portals should provide extensive API documentation and client libraries. And, of course, APIs should have minimal downtime and clear communication channels with developers to minimize potential disruptions.

The Bottom Line

Fintech startups are reshaping how consumers access their financial data. With regulators worldwide embracing open banking, banks and other financial institutions should look closely at their APIs to ensure quality and consistency. SwaggerHub, ReadyAPI, and other tools can help maximize efficiency and quality across your teams.

Get started with SmartBear's free API development tools, or start your free trial of SwaggerHub or ReadyAPI to see how they can help ensure quality and support your entire team.