The global fintech market is projected to reach over $300 billion by 2025, according to Research and Markets, growing at a blazing 20% compound annual growth rate. Over the past decade, Venmo grew to over 50 million users, processing over $200 billion in annual transactions. And that's just one of many wild success stories in the nascent industry.

Since the banking industry is highly regulated, most fintech startups focus on analyzing or transferring funds rather than holding deposits or making investments. As a result, they must interface with banks and other financial institutions to access accounts and transactions. And, until recently, that was a massive headache for engineers.

Let's look at how open banking is paving the way for fintech, why it's becoming essential for banks worldwide, and how to develop and maintain open banking APIs from a high level.

Open banking is quickly moving from an obscure feature to a regulatory and market-driven requirement for banks and financial institutions.

What is Open Banking?

Open banking refers to providing secure access to financial data from financial institutions through application programming interfaces (APIs).

For example, suppose that Venmo wants to connect to a user's bank account to process a transaction. It would be nearly impossible to support 50+ banks if each one had a proprietary authentication scheme and data access protocols. Fintech companies would need an army of engineers to keep these links up to date.

Before 2017, many fintech startups had to access customer data through a practice known as "screen scraping." In essence, fintech companies would connect to a user's banking website using a headless web browser and access their account details. The problem is that these processes are inherently insecure and error-prone.

Banks and fintech companies eventually agreed to create the Financial Data Exchange, or FDX, a nonprofit consortium of more than 200 banks, fintech companies, and financial institutions, including Chase, Citi, PayPal, and Plaid, in 2017. And in 2018, the Payment Services Directive (PSD2) went into effect in the UK and Europe, mandating API access to banks.

Advantages in Financial Services

Open banking APIs provide a better alternative to screen scraping, unlocking benefits for banks, fintech, and consumers.

Some of the most significant advantages include:

- Innovation - Open banking APIs make it easier for fintech companies to build innovative products. They can easily support hundreds of different banks without creating and maintaining separate adapters to connect with each one.

- Connectivity - Open banking APIs ensure secure and efficient connectivity. Fintech companies don't have to worry about handling hundreds of edge cases or errors. And consumers can always access their financial data when they need it.

- Customer Experience - Fintech companies may avoid supporting banks that don't have open banking APIs, creating a poor user experience and potential churn. This is particularly true as fintech innovations continue to saturate the market.

- Transaction Volume - Many fintech companies help increase transaction volume, making it a win-win for banks and their partners. For instance, connecting brokerages to trading applications could increase brokerage fee revenue.

Building & Sharing Open Banking APIs

Many banks still use 3270 terminals to access and share financial information. So APIs can seem like a foreign concept.

Open banking APIs provide programmatic access to information like account balances or transactions. For example, the Chase Bank Account and Customer Information API uses OAuth to authenticate a customer and then returns an access token that third parties can use to make GET requests that produce a JSON response.

Some potential API endpoints to consider include:

- GET /accounts

- GET /accounts/:id

- GET /accounts/:id/transactions

Many banks provide access to these APIs directly to developers or work with open banking platforms. For example, Plaid standardizes banking APIs, so developers can seamlessly work with multiple banks. Tink, Solarisbank, and Yapily are other providers that work in the European Union, providing similar functionality.

API Standards & Governance

Open banking relies on APIs, so it's imperative to ensure these APIs are robust, standardized, and well-documented.

The OpenAPI specification is one of the best ways to standardize, document, and manage your open banking APIs. You can think of the specification as grammar rules that define how the API works. These rules help engineers understand how to use the API and make it possible to automatically validate APIs to ensure consistency.

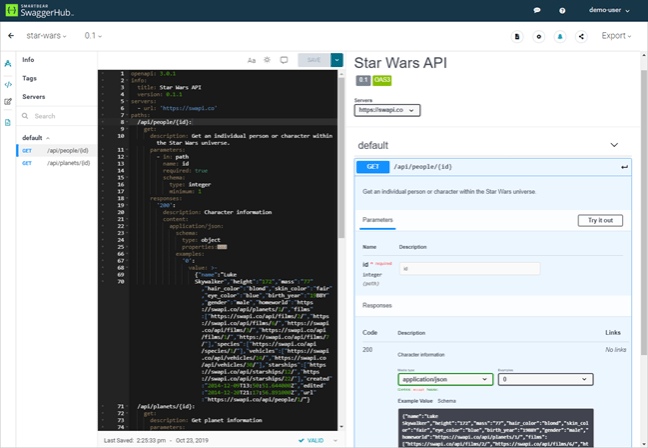

Example of an OpenAPI specification in SwaggerHub. Source: Swagger

Swagger is the most widely used open-source toolset for developing APIs with the OpenAPI specification. You can use these tools with either a design-first (e.g., capture requirements and then write code) or a code-first (e.g., generate specifications from existing code) approaches, making it a very flexible way to develop API standards.

There are a few essential open-source Swagger components:

- Swagger Editor is a browser-based editor where you can write OpenAPI specifications.

- Swagger UI renders OpenAPI specifications as interactive API documentation for engineers.

- Swagger Codegen generates server stubs and client libraries from an OpenAPI specification.

SwaggerHub goes a step further and provides a collaborative platform where you can define APIs using the OpenAPI specification and manage APIs throughout their lifecycle. It integrates the open-source Swagger tools into a single platform where you can coordinate the entire workflow of an API cycle across your team. At the end of the day, Swagger enables you to create a single source of truth for both internal- and external-facing APIs. You can use Swagger's tools to develop standardized documentation, evaluate API changes, and even generate client libraries that you can provide to third parties, making it easier for them to build fintech applications.

The Bottom Line

Fintech is quickly becoming a $100+ billion market that relies on access to financial data from banks and other financial services partners. Rather than screen scraping, open banking aims to provide secure and standardized access to data through APIs. And the OpenAPI specification is an excellent way to build open banking APIs.

If you're building open banking APIs, Swagger's robust toolset can help you build and enforce OpenAPI standards while making it much easier to generate documentation, provide convenient client libraries, and enforce API specifications over time to ensure consistency.

Start by creating a free account today!